[ad_1]

One of the best investments we can make is in our own knowledge and skills. With that in mind, this article will go over how we can use Return On Equity (ROE) to better understand a business. To keep the lesson practical, we’ll use ROE to better understand Ford Motor Company (NYSE:F).

ROE or return on equity is a useful tool to assess how effectively a company generates returns on the investment it receives from its shareholders. Put another way, it shows the company’s success in turning shareholder investments into profit.

Check out our latest review for Ford Motor

How Do You Calculate Return On Equity?

ROE can be calculated using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, based on the formula above, the ROE for Ford Motor is:

21% = US$8.9b ÷ US$42b (Based on the last twelve months to September 2022).

‘Return’ refers to the company’s earnings in the previous year. So, this means that for every $1 of its shareholder’s investments, the company generates a profit of $0.21.

Does Ford Motor Have a Good ROE?

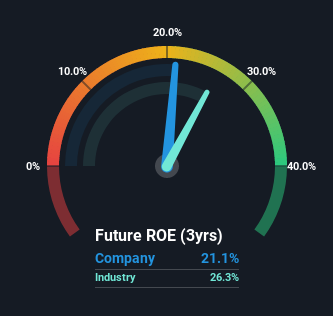

Arguably the easiest way to assess a company’s ROE is to compare it to its industry average. However, this method is only useful as a rough analysis, as companies are quite different within the same industry classification. As shown in the graphic below, Ford Motor has a lower ROE than the average (26%) in the Auto industry classification.

That’s certainly not ideal. However, we think that a lower ROE may still mean that a company has an opportunity to improve its earnings with the use of leverage, provided that its current level of debt is low. A heavily indebted company with a low ROE is a different story altogether and a risky investment in our books. To find out the 2 risks we identified for Ford Motor, visit our risks dashboard for free.

The Importance of Debt To Return Equity

Companies usually need to invest money to grow their profits. Cash for investment can come from previous year’s earnings (retained earnings), issuing new shares, or borrowing. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the debt required for growth will boost profits, but will not affect shareholders’ equity. In this way the use of debt will boost ROE, even if the basic economics of the business remain the same.

Ford Motor’s Debt Consolidates And Its 21% Return On Equity

It appears that Ford Motor is using debt extensively to improve its returns, as it has an alarmingly high debt to equity ratio of 3.05. Its ROE is respectable, but not impressive once you factor in all the debt.

Conclusion

Return on equity is a way we can compare the quality of its business of different companies. In our books, the highest quality companies have a high return on equity, despite low debt. If two companies have roughly the same level of debt to equity, and one has a higher ROE, I generally prefer the one with the higher ROE.

But when a business is of high quality, the market will often bid it at a price that reflects this. The rate at which earnings are likely to grow, relative to expectations of profit growth reflected in current prices, should also be considered. So I think it might be worth checking out Free report on analyst forecasts for the company.

But remember: Ford Motor may not be the best stock to buy. So check it out Free list of interesting companies with high ROE and low debt.

Valuation is complicated, but we help make it simple.

Find out if Ford Motor is potentially over- or under-priced by checking out our comprehensive review, which includes fair value estimates, risks and caveats, dividends, insider transactions and financial health.

Check out the Free Review

Do you have feedback on this article? Worried about content? Please contact directly to us. Alternatively, email editorial-team (at) simplywallst.com.

This Simply Wall St article is general. We provide commentary based on historical data and analyst forecasts using only an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take into account your goals, or your financial situation. We aim to bring you long-term focused analysis driven by primary data. Note that our review may not factor in the company’s latest price-sensitive or material quality announcements. Simply Wall St has no position in any of the stocks mentioned.

[ad_2]

Source link