[ad_1]

Final investment decisions (FIDs) are being forecast for a series of major untapped oil and gas fields in the UK North Sea next year.

Advances are expected in Perth, Bentley and Brace in the North Sea, with announced FIDs planned for Cambo and Rosebank, analytics firm Valigence said.

“Commitments to major greenfield developments including Kembo and Rosebank are expected,” the firm said.

“We may see some progress towards FID at the latest in large, underdeveloped areas including Perth, Bentley and Brace.”

Perth

Parkmead Group’s (LON: PMG ) 100%-owned Greater Perth precinct in the Central North Sea is one of the largest undeveloped projects in the region.

Holding about 55 million barrels of recoverable oil equivalent, discussions are underway with CNOOC six miles south to use the nearby Scott platform to source production from Perth.

A finance advisory was prepared at Parkmead over the summer to help Parkmead find a partner for the development.

Bentley and Brace

EnQuest (LON: ENQ ) acquired the operatorships of both Bentley and Brace in 2021; The large oilfields are close together in the northern North Sea, about 85 miles south-east of Shetland.

The London-listed firm said in March it had added about 250m barrels of oil equivalent to its 2C reserves and was exploring a range of development options.

He added that in 2022 the Kshetra Vikas Plan will be taken forward, though this is yet to filter down to the public.

The two fields are close to each other, and a boss at Xcite Energy, which operates Bentley, told Energy Voice that developing them in tandem was an “obvious” solution.

He added that the pair “probably belong to the same region, or they are very closely related”.

Bentley is located less than 10 miles from EnQuest’s producing Kraken field.

Cambo and Rosebank

Cambo and Rosebank, west of Shetland, the largest untapped projects in the UK, are due for FID in 2023.

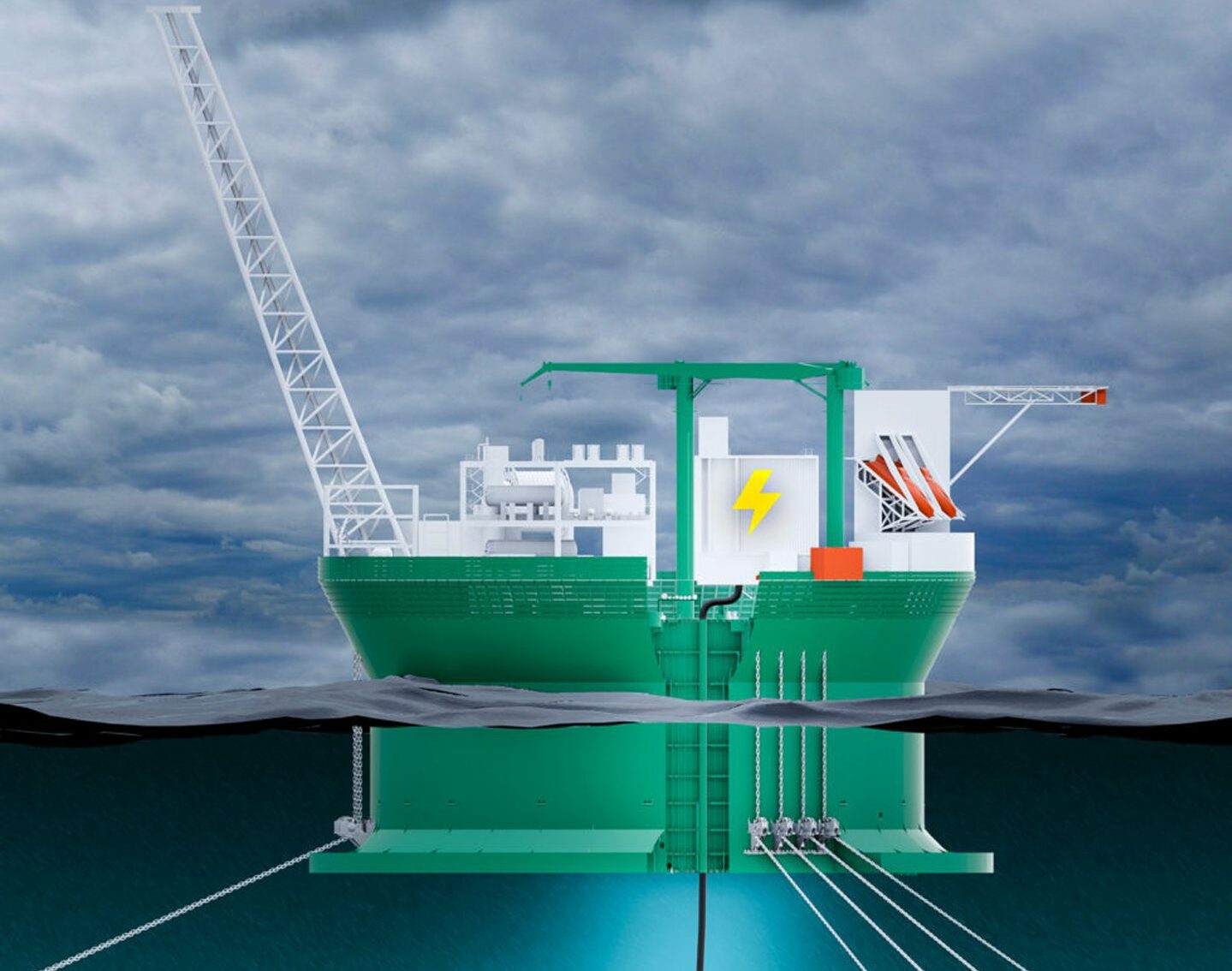

Equinor operates Rosebank, which is believed by its partners to have 300 million recoverable barrels in its first phase, which will produce through the electrification-ready Knarr FPSO.

Ithaca Energy (LON:ITH), a partner at Rosebank, operates the Kambo oilfield in the same region.

Chairman Gilad Myerson said the firm had “line of sight” to allow development next year.

An exploration license for Kambo was awarded in 2001 and its first phase is targeting around 170 million barrels of oil.

It is also poised for electrification, hampering growth despite the climate controversy.

Shell is a 30% partner in the project and, having said last year that it would not pursue investment in the area, has not pulled out of the project.

North Sea boss Simon Roddy recently told Energy Voice that Shell was “still in license and still looking at options”.

Windfall tax and electrification

Veligens also predicted “plans for electrification of offshore facilities”, in the wake of recent events.

Earlier this month, Equinor, Ithaca and BP signed an agreement to advance electrification in West Shetland following recent UK windfall tax reforms that effectively subsidized such projects.

Last month, Chancellor Jeremy Hunt announced a rise in the Energy Profits Levy, but kept the General Investment Allowance the same.

However, the allowance was increased specifically for projects to electrify oil and gas assets – meaning companies spending £100 on decarbonisation would get £109.25 back.

Ithaca, BP and Equinor signed an agreement to explore electrification options for the vast Clare, Rosebank and Cambo fields west of Shetland.

“This is potentially even more attractive post-EPL” as companies look for capital spending opportunities in the coming months, Velijns says.

The group added that this is “particularly” the case “as upstream decarbonisation is not subject to a reduced investment allowance.

Increased appetite for mergers and acquisitions

The organization has also shown increased opportunities for merger and acquisition deals.

Assets may change in the new year as the SNS assets of CNOOC International, ONE-Dyas, Suncor, Shell and ExxonMobil represent a “larger pool of opportunities”.

However, this is dependent on there being “sufficient buyer appetite” according to analysts “which now appears to be in strong supply” but the institution “for how long?” raises the question.

Vaughn Telford, senior analyst at Westwood Energy, told Energy Voice earlier this year: “Commodity price volatility can lead to delays in agreeing terms on M&A deals, as the gap between buyer and seller value expectations can be wider.

“That said, the longer prices stay high, the more companies are likely to have cash available for M&A activities, which could expand the buyer pool.”

Recommended for you

West of Shetland oilfields for a $500m value bump from electrification

[ad_2]

Source link

© Provided by EnQuest

© Provided by EnQuest

© Provided by Welligence

© Provided by Welligence