The American tree fell. On Friday, when more than half a million jobs were created in January, expectations of a halt in hikes were dashed, but the tech giant’s below-average earnings weighed on investor sentiment.

The US economy added 517,000 jobs last month. This wage increase exceeded the forecast by economists by 188,000 people.

Technology stocks Nasdaq Composite ( ^IXIC ) fell 1.6%

Maintaining flexibility in the labor market could ease pressure on the Federal Reserve (H) to end its rate hike campaign, as markets began betting on the end of the year.

The overall labor market is showing exceptional strength,” Goldman Sachs Asset Management chief investment officer Alexandra Wilson Elizondo said in a statement. . . . .

Wilson Elizondo added: “The report cuts premiums more likely since there are no significant signs of stress that can trigger a rate cut.” “In other words, this event gives H e the ability to ride out the macroeconomic lull, while the risk of over-tightening that triggers a recession continues.”

In terms of earnings, the market’s biggest companies, including Apple ( AAPL ), Amazon ( AMZN ), and Google’s parent company Alphabet ( GOOG, GOOGL ), released four results that disappointed Wall Street. Apple shares rose 2.4% on Friday, reversing losses, while Amazon and Alphabet shares fell 8.4% and 2.7%, respectively.

Apple said sales fell 5% as the fallout from China’s coronavirus and worker protests hit Foxconn’s Chinese factories over the same period. The company’s flagship, iPhone sales, fell 8% year-over-year to $65.8 billion, a big loss estimated at $68.3 billion.

Big tech setbacks, work reports, problem-solving: what is the market doing?

Investing.com – Apple, Alphabet, and Amazon all reported disappointing quarterly results in one way or another, sending US stocks down. The Labor Department is expected to report its weakest wage growth in nearly two years, and the ISM is expected to release its nonfarm payrolls index for January. Gautam Adani fell to agency estimates but will face serious debt service challenges in the coming months as oil prices near multi-year lows over the weekend. May 3

1. Big Tech Dormitory

The three tech giants said late Thursday that they are preparing to release the results of the four, allaying concerns about a continued slowdown in some of the stock groups that have hit the market over the past decade.

Apple Inc (NASDAQ: AAPL) reported its first quarterly revenue decline in more than three years in mid-2022 due to manufacturing problems in China, while Alphabet Inc (NASDAQ: GOOGL ) also reported a smaller-than-expected decline. . For the second time in Theon’s history, both companies’ prices were impacted by a stronger dollar that impacted their overseas sales.

Meanwhile, Amazon (NASDAQ: AMZN) outperformed, but shares fell after reports of sluggish cloud growth for its Internet Services division.

In the top markets, Apple’s shares are down 2.7%, Alphabet’s 4.7%, and Amazon’s 5.3%.

2. Employment Report Shows Slowing Employment

The US released its employment report for January, which showed that nonfarm payrolls fell by 185,000 for the fourth month in a row. If approved, the minimum net profit for private companies will increase from January 2021.

ADP said earlier this week the private sector plummeted, with total jobs cut in half to 106,000 since November. This is the final step for the last 9 months.

The Institute for Supply Management’s Non-Manufacturing Index also provided a disappointing (but much smaller) survey of manufacturing regions.

3. TechChill touches control when opening. Nasdaq Continues Claiming Weekly Rise

US stocks are expected to fall after major technical disappointment, but remain unchanged until the employment report.

As of 6:15 AM ET (1115 GMT), Dow Jones futures are down 127 points (0.4%), S&P 500 futures are down 0.9% and NASDAQ 100 futures are down 0.9%. The 1.6% Nasdaq Composite could rise more than 3% per share as low-interest rates are likely to continue to support competing stocks.

Another stock you will notice later is Ford Motor Inc. (NYSE: F), a quick analysis of earnings on Thursday overlooked strong earnings and an upbeat outlook for the tech giant. Ford shares fell 7.8% and Qualcomm Inc (NASDAQ: QCOM ) also declined after reporting four below-consensus earnings.

This week’s results include news from Aon Inc (NYSE: AON), Cigna Inc (NYSE: CI), Regeneron Inc (NASDAQ: REGN), and chemical company LyondellBasell Inc (NYSE: LYB).

4. Adam Rests

Fall in stocks and bonds issued by corporate chain Gautam Adani after agency’s resolution Fitch said the uproar over the Hindenburg Inquiry over stock market manipulation and fraud would not have a “direct impact” on ratings.

Adani made several efforts to subsidize debt servicing when the billionaire went bankrupt to raise $2.4 billion in the capital. Adani Enterprises’ exchange rate is well below the market range, so closing the deal is “immoral,” Adani said in a social media news video.

Adani company’s holdings are also supported by strict margin requirements imposed by the Indian Stock Exchange on Friday, making it more expensive to short the stock. But the disaster wiped out more than $100 billion from the stock market and baffled Prime Minister Narendra Modi, whose agenda Adani was passionately pushing.

5. Oil flows between a strong China and a weak US

Crude oil prices moved over the weekend as markets were still torn between expectations of weak demand in the West and recovery in China. Earlier this month, China announced it would cut gasoline exports and cut other gasoline as US gasoline inventories hit their highest level in nearly a year.

At 6:45 a.m. ET, US crude oil was down less than 0.1% to $75.86 per barrel and Brent crude was down 0.1% to $82.09 per barrel.

Separately, Russia’s energy minister rejected proposals to cut exports of the product in response to EU and US bans, particularly fearing a rapid phase-out of diesel.

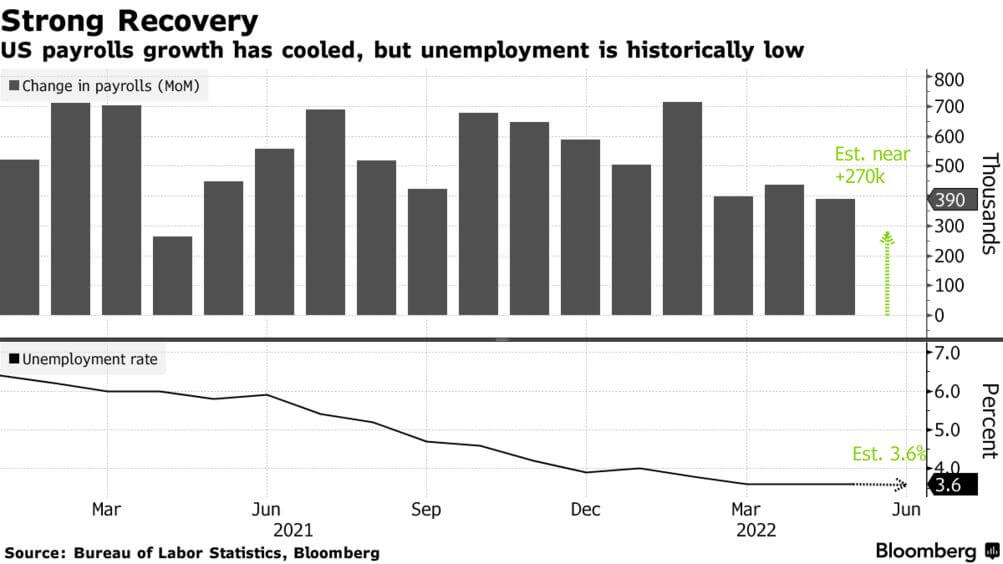

Employment Report: In January, the US economy added 517,000 jobs and the unemployment rate fell to 3.4% amid labor market turmoil.

US employment growth beat expectations in the first month of the year and the labor market remain strong as the Fed tightens its anti-inflationary measures.

The Department of Labor releases its monthly employment report for January on Friday at 8:30 am EST.

Number of jobs in the non-agricultural sector: +517,000 vs. +188,000 projected

- Unemployment: 3.4% vs. 3.6% in the future

- Average hourly wage m/m: +0.3% vs +0.3% expected

- Average hourly earnings y/y: +4.4% compared to the previous year. +4.3% expected

Unemployment data on Friday showed labor costs rose from the previous month, with 260,000 jobs added. Seasonal sales fell 3.4% in January, the lowest since 1969.

The data for the downturn came as the monthly data leading up to the January earnings report showed a downward trend and the employment situation began to show signs of improvement.

The Fed raised rates by 450 basis points (4.5%) until March 2022 to contain the recession and inflation. Despite these steps, the US labor market remains strong, according to Friday’s data.

US stock futures fell after the announcement as recent reports that the US (H) may put its rate hike campaign on hold for the next few months dampened investor hopes. They suffered some losses at the beginning of Friday’s session but remain in the red.

After the US central bank announced its latest rate hike on Wednesday, Fed Chairman Jerome Powell said the labor market remains volatile and needs below-trend growth and some domestic support to contain inflation. situation