[ad_1]

Authors: Stacey Morris, CFA and Philip Segal

summary

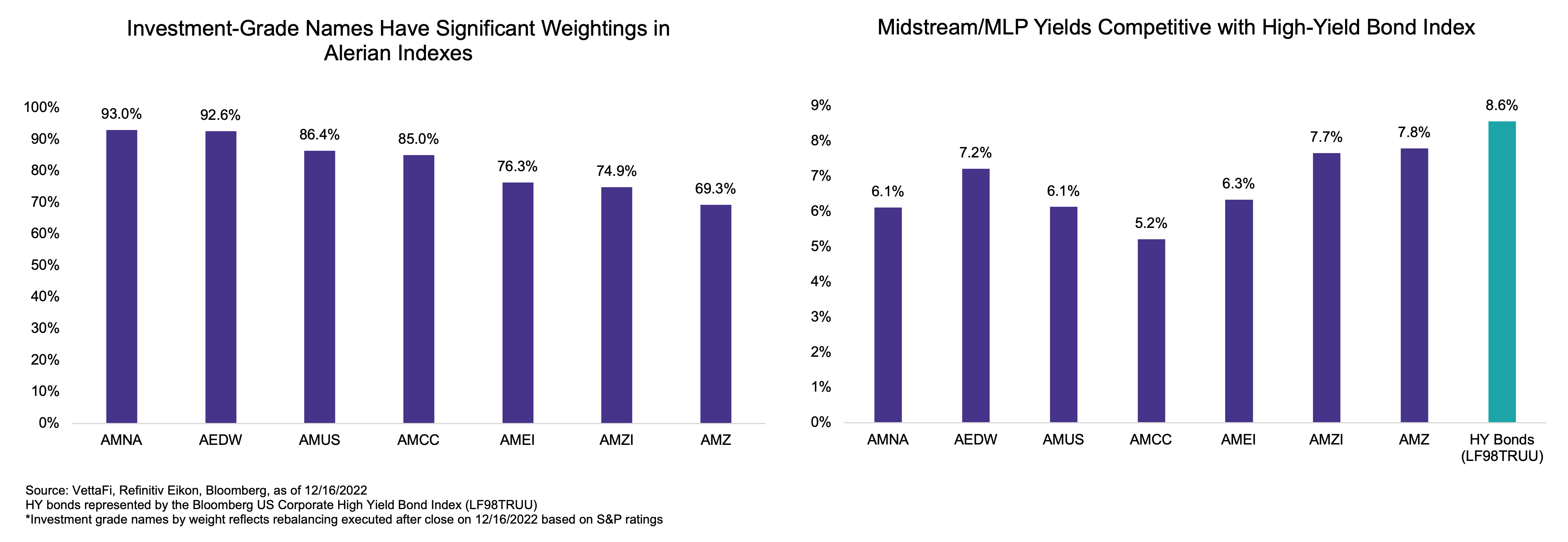

- Although midstream capital spending has been reduced and reliance on debt has eased somewhat, credit ratings are still important for energy infrastructure companies.

- By weighting, investment-grade names make up the majority of the Alerian Energy Infrastructure Index.

- Energy infrastructure indexes, especially MLP indexes, provide returns that rival junk bonds, but the median return comes from companies with much higher credit quality.

The midstream space had a good year, as the broader energy sector made gains in an overall challenging market. Resilient to elevated inflation and volatile oil prices, energy infrastructure companies performed well, and free cash flow generation fueled buybacks and dividend growth. Given the macro backdrop and company-level doom, the financial health of the midstream space was more of an afterthought. Granted, it’s been over two years since we last provided detailed midstream/MLP credit ratings. This note provides an updated view of credit ratings at the company and index level using the Alerian Energy Infrastructure Index Package.

Why is an investment grade credit rating important to the midstream?

Midstream companies are probably less dependent on debt financing than in the past. As detailed in this July 2022 note, the drop in capex from 2019 to 2021 can be measured in the billions of dollars for the biggest names in this space. Furthermore, many companies have used excess cash flow to reduce debt, and leverage ratios have improved in recent years (In more detail). Although midstream capital spending has been reduced and reliance on debt has eased somewhat, credit ratings are still important for energy infrastructure companies.

An investment grade credit rating gives companies better access to the debt markets and enables them to receive more favorable rates. A lower cost of debt saves money and enables better returns on growth projects. Lower rates for investment grade companies are perhaps a more significant advantage in today’s higher interest rate environment. For example, the yield spread between the investment grade corporate bond benchmark and the high yield benchmark was 420 basis points as of December 16, 2022. For all of 2021, the average yield spread between the investment grade and high yield index was just 260 basis points . Companies continue to prioritize maintaining investment grade metrics, with Plains All American’s (PAA) and Cheniere’s (LNG) capital allocation frameworks from this fall, including targets related to maintaining an investment grade credit rating (In more detail).

Larger midstream players tend to have stronger credit ratings.

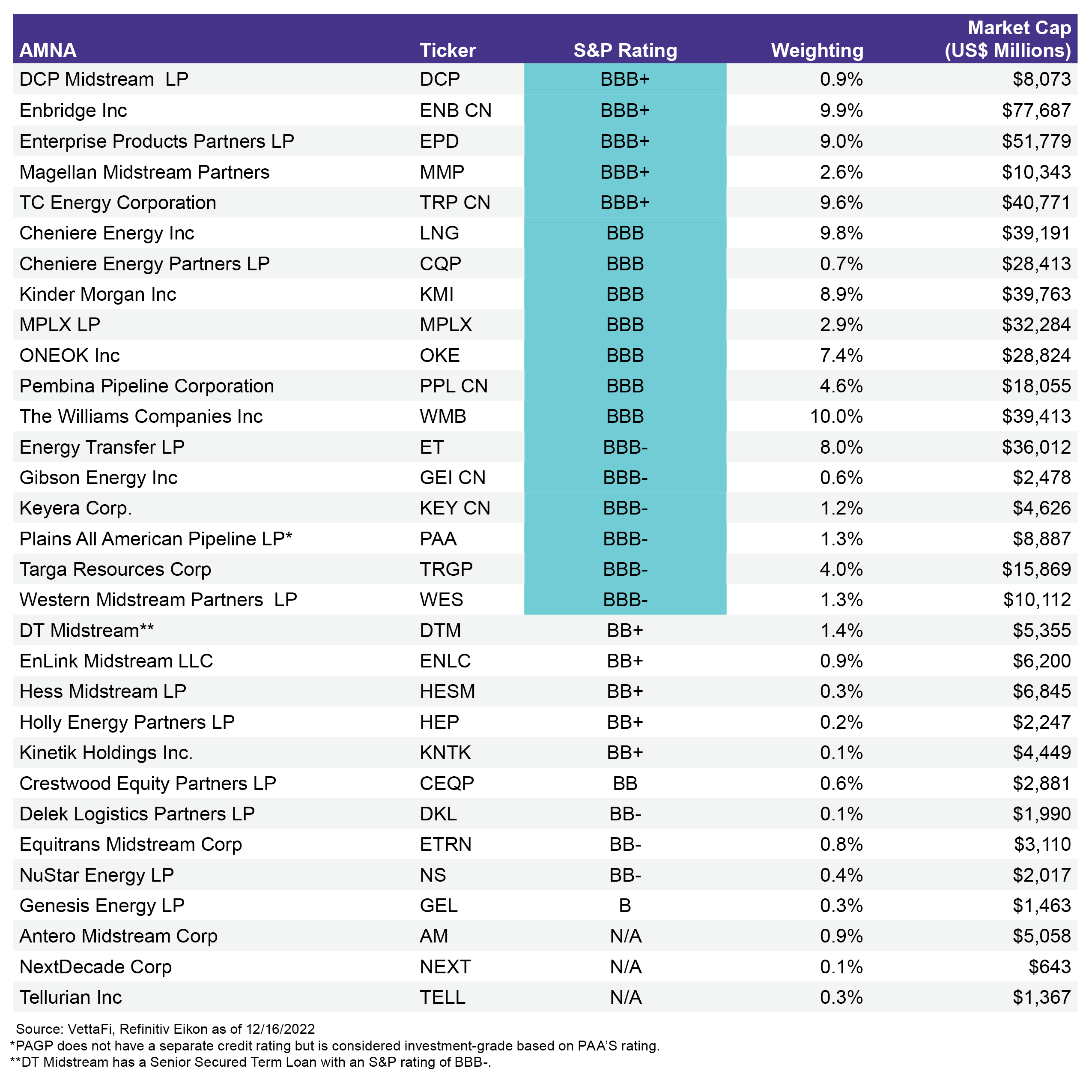

Looking at S&P’s company-level credit ratings, the bigger names in the space tend to have stronger ratings. The appendix to this note contains a table showing the credit ratings for the constituent parts Alerian Midstream Energy Index (AMNA). Of the 32 names in the index, 19 have investment grade credit ratings from S&P (BBB- or better, including PAGP as noted below). Of the investment names, the average market capitalization is over $27 billion, while the average market capitalization of AMNA constituents that have a lower than investment grade, or no S&P credit rating, is between $3.3-3.7 billion.

Looking at the investment grade weightings at the index level.

By weighting, investment-grade names make up the majority of the Alerian Energy Infrastructure Index. Larger companies that tend to have healthier balance sheets also tend to have higher weightings in the Alerian indices since the weightings are based on float-adjusted market capitalization. Dividend weighted Alerian Midstream Energy Dividend Index (AEDV) is an exception to this. It should be noted that all indexes shown in the charts below have a 10% limit on individual names. In general, midstream indices that include corporates tend to be more heavily weighted toward investment grade companies, with AMNA having the highest investment grade weighting at 93.0%, followed by AEDV at 92.6%. The Alerian US Mid Energy Index ( AMUS ), which includes only US MLPs and C-Corps, ranks third at 86.4%. Meanwhile, investment level weighting for Alerian MLP Infrastructure Index (AMZI) and Alerian MLP Index (AMZ) is lower with 74.9% and 69.3%, respectively.

Looking at index returns along with investment-level weights provides interesting context. In general, indices with higher investment grade weights tend to have lower returns, which refers to MLPs typically providing higher returns than their C-Corp counterparts. The dividend weighting scheme for AEDV results in the highest return among indexes with MLPs and corporations. It’s also notable that energy infrastructure indices, particularly MLP indices, provide yields that rival the junk bonds represented by the Bloomberg US High Yield Corporate Bond Index (LF98TRUU) in the chart above, but the midstream/MLP income comes from companies with much higher credit quality. It should also be noted that MLPs provide the potential for tax-deferred income, with MLP-focused ETFs replicating those benefits (In more detail).

Essence

Although less dependent on debt financing than in the past, an investment grade credit rating is still desirable for mid-sized companies. The better the credit rating, the easier it is to access the debt markets and receive more favorable rates. In short, companies want to pay as little as possible to borrow money. The Alerian Energy Infrastructure Indexes generally lean toward investment-grade names by weighting while providing returns competitive with much riskier assets.

AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA). AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMEI is the underlying index for Alerian Energi Infrastructure ETF (ENFR) and ALPS Alerian Energi Infrastructure Portfolio (ALEFKS). AEDV is the underlying index for Alerian Midstream Energi Dividend UCITS ETF (MMLP) and ETRACS Alerian Midstream Energi High Dividend Index ETN (AMND). AMZ is the underlying index for the JP Morgan Alerian MLP Index ETN (AMJ) and the ETRACS Quarterly Pay 1.5k Alerian MLP Index ETN (MLPR).

Related Research:

Midstream/MLPs: Benefits of a Capital Allocation Framework

Midstream/MLPs: Level up with deleveraging

Midstream/MLPs: Free Cash Flow Powerhouse

Outside of the K-1: Tax treatment for an MLP fund versus an MLP

Appendix

[ad_2]

Source link