Ahead of the 2024 general election, Narendra Modi is taking the tone of the government’s latest comprehensive economic policies, announcing preferential treatment for the poor, cutting income tax for middle-income earners, and increasing capital spending.

Finance Minister Nirmala Sitharaman’s speech, which refers to tribes, is often made in Tripura, Nagaland, Meghalaya, Mizoram, and Chhattisgarh, reaching a significant portion of the state’s voting population. and Madhya Pradesh, or special packages for Karnataka.

Notions of castes, scheduled castes, and other less developed groups were echoed in the debate over the fragile budget for minorities when the Prime Minister announced that he was addressing the newly formed BJP National Executive.

Rs 15,000 crore allocated in Budget 2023 to support vulnerable tribal groups.

This PVTG will provide families and households with basic services such as shelter, clean water and sanitation, better education, health and nutrition, communications and communications, and sustainable livelihoods can,” Sitharaman said in his budget email. As per the Tribal Action Plan, Rs 15,000 crore has been allocated for the mission over the next three years.

Commissioning the comprehensive teacher recruitment plans for the Eklavya Model Tribal Boarding School, he said: “Over the next three years, the center will recruit 38,800 teachers and staff for the Eklavya Model Boarding Schools serving 3.5 million students. “

Budget 2013: This is a dream budget

I think the figures announced by the Secretary of the Treasury are very reasonable and pragmatic. No specific goals or responsibilities. We can rightly say that this budget will cover everything on our list.

Given the current macroeconomic and national conditions, the dream budget of the budgetary union is 2023-2024. A focus on growth in particular is critical if they want to ensure that the cyclical recovery of the private sector continues. A 33 percent increase in capital spending by the government, along with Rs 2.4 crore allocated to railways, is expected to give the economy a big boost.

The infrastructure will also help boost the rural economy by increasing employment and income, along with agricultural and domestic renewal. The figures released by the Secretary of the Treasury seem very reasonable and pragmatic. No specific goals or responsibilities.

Budget 2023: the economy

The government introduced a new tax system for the 2020 budget, which did not find many listeners without exceptions. In the 2023 national budget, the government fails to comply with the tax system.

They are of great importance to the economic economy. This is the main message of Finance Minister Nirmala Sitharaman’s budget speech. The Ministry of Finance has set seven priorities (saptarishi) for the country, with the “financial section” designated as the seventh. There are four main announcements worth noting. This will pave the way for a financially successful India where the latest milestone will also be raised financially.

A new tax system had been built.

The government introduced a new tax into the 2020 economy, which without exception did not have many applicants. In the 2023 national budget, the government fails to comply with the tax system. All changes are related to personal income tax. Notably, your income up to 7 lacks is now taxable, but only under the new tax regime. The former cost 5,000 rupees.

The government has revised the tax tables for voters of the new government. Interestingly, it has also introduced a standard price of Rs 50,000 with part of the new features. This will give people more income that they can use to invest. The government lowers tax rates

The 2023 State Budget encourages economic recovery

The government must ensure that revenue growth is limited.

The EU budget for 2023 is presented against a backdrop of high expectations. The government must find the right balance between supporting economic growth and not violating budget calculations. In that sense, the budget must be considered from both a periodic and a long-term perspective. Overall, the economy is in good shape now and the balance sheet supports further improvement. From a cyclical perspective, the economy is currently recovering from a three-year shutdown caused by external shocks. On the other hand, the economy is under pressure from sluggish demand and needs fiscal and financial support. But as the economy recovers and private demand grows, it will be prudent to reduce fiscal support.

In this context, contracts devoted to fiscal policy are reasonable (the fiscal deficit is set in nominal rupiah and reduced by half a percentage point as a percentage of GDP). The fiscal contract, on the other hand, eased interest rate hike pressure on the RBI. The spread of lower tax rates will stimulate private investment in both business and construction and will have a multiplier effect on the economy. We can be optimistic if the momentum for economic recovery gets better and continues, with the reforms that have been carried out on the supply side (especially RERA) and the financial sector (IBC).

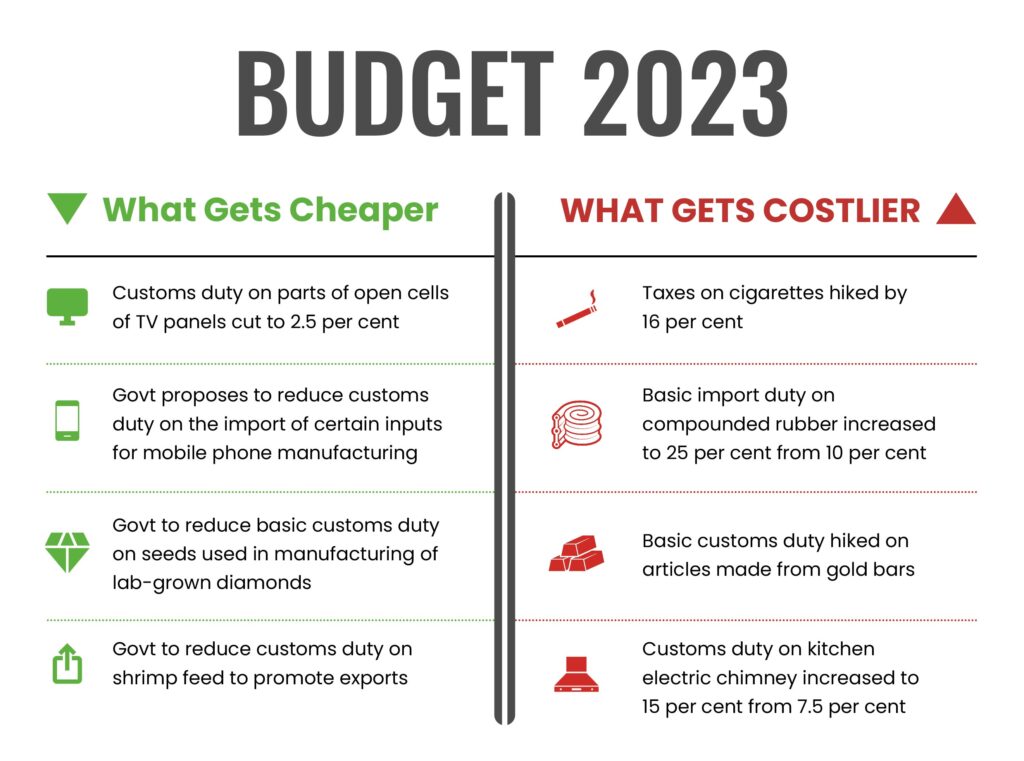

Coalition Budget 2023-2024: What’s Cheaper and Should You Pay More?

While cigarettes burn a hole in a smoker’s pocket, the camera lenses used in cell phones are now cheaper. Below is a list of all items that will see their prices reduced or increased in the 2023 Commonwealth Budget.

While announcing the budget of the five unions, Finance Minister Nirmala Sitharaman made important announcements, including reducing the income tax rate from 5 lacks to 7 lacks under the new tax system.

This is the last full budget of the Modi-Narendra government ahead of the 2024 general election next year.

Sitharaman’s speech was also about which products will drain consumers’ pockets and be affordable.

what could be cheaper?

The central government said it would cut tariffs on certain components and materials, such as the camera lenses used in cell phones.

Sitaraman, managing director, said, “We propose to continue lowering import tariffs on certain parts and materials, such as camera lenses and lithium-ion battery cells, to increase the added value of domestic mobile phone manufacturing.” for one more year. . she says.

The finance minister said the general capital and equipment needed to manufacture the lithium-ion cells used in electric vehicle batteries would be exempt from tariffs to support the green movement.

What should be more expensive?

Smokers will have to prove more cash than the government plans to increase the National Emergency Fund (NCCD) by 16% for certain acids.

The basic customs value of the composition of rubber is “10% to” 25% “or” 30/kg, whichever is less “, which is the same as natural rubber, except for latex, which increases slippage when compressed, said the Minister of Finance…

The price of electric rice cookers increased as the basic tariff was increased from 7.5% to 15%.

The 2.5% copper scrap levy “will continue to ensure the availability of raw materials for secondary copper producers operating mainly in the MSME sector (Ministry of Small and Medium Enterprises),” said the finance minister’s budget.

Highlights of the 2023-2024 union budget

Apart from increasing the income tax rate, the government also raised the tax rate and raised the tax exemption limit to 3 lacks.

Sitharaman said the budget deficit is expected to reach 5.9 percent of gross domestic product (GDP) in 2023-24.

The government paid Rs 2.40 crore to Indian Railways, which according to the Minister of Finance was “the highest amount ever paid, nine times the amount paid in 2013-2014”.

AM Awas Yojana’s expenses increased by 66% to over Rs 79,000 crores.

The center increased its capital investment by 33 percent to Rs 10 million, or 3.3 percent of GDP.

An expenditure of Rs 35,000 crores was also made available from the union budget to achieve the goal of zero grid and power transmission.