[ad_1]

Core understanding

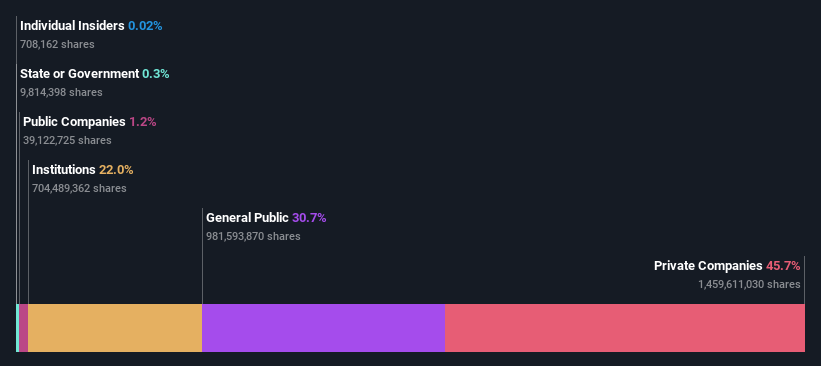

- Significant control over Tata Power by a private company means that this group may have significant influence over decisions related to management and governance.

- The top 2 shareholders own 52% of the company

- Owns 22% of Tata Power

To find out who really controls The Tata Power Company Limited (NSE:TATAPOWER), it is important to understand the ownership structure of the business. And the group holding the largest piece of the pie is private companies with 46%. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

And following last week’s share price drop of 9.2%, private companies suffered the most losses.

Let’s take a closer look to see what different types of shareholders can tell us about Tata Power.

See our latest analysis for Tata Power

What does institutional ownership tell us about Tata Power?

Many institutions measure their performance against an index that approximates the local market. So they tend to pay more attention to companies that are included in major indexes.

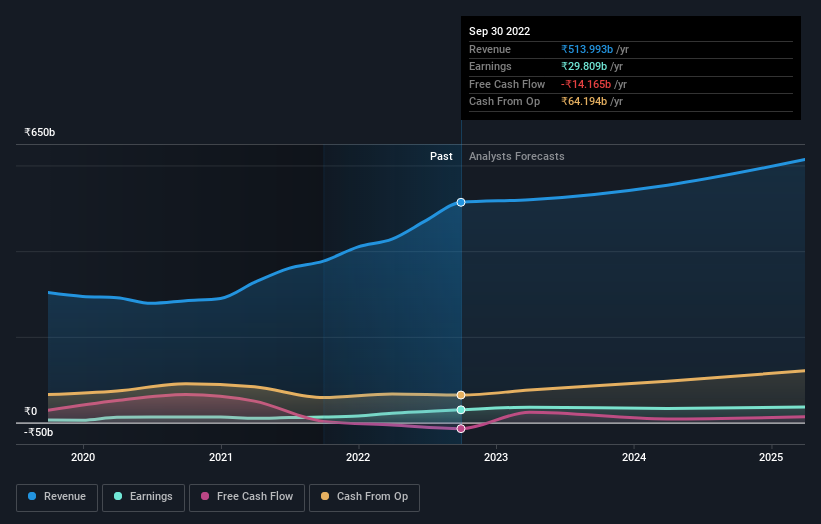

Tata Power already has an institution in the share register. In fact, they own a respectable stake in the company. This indicates some credibility among professional investors. But we can’t rely on that fact alone since institutions make bad investments sometimes, just like everyone else does. It is not unusual to see a large stock price drop if two large institutional investors try to sell out of the stock at the same time. Therefore, it is worth checking the recent earnings trajectory of Tata Power, (below). Of course, keep in mind that there are other factors to consider, too.

The hedge fund does not have many shares in Tata Power. The company’s largest shareholder is Tata Sons Private Limited, which owns 46%. At the same time, the second and third largest shareholders hold 6.3% and 1.7%, respectively.

A more detailed study of the shareholder register has shown us that 2 of the leading shareholders have a total ownership of the company, through 52% shares.

While studying institutional ownership for a company can add value to your research, it’s also good practice to research analyst recommendations to gain a deeper understanding of a stock’s expected performance. There are a lot of analysts covering the stock, so it might be worth seeing what they predict, too.

Insider ownership of Tata Power

The definition of internal can vary slightly between countries, but the members of the committee are always counted. Management finally answers to the committee. However, it is not uncommon for managers to be board members, especially if they are the founder or CEO.

In general, I consider internal ownership to be a good thing. However, on occasion it makes it very difficult for other shareholders to hold the board accountable for decisions.

Our latest data indicates that insiders own less than 1% of The Tata Power Company Limited. We note, however, that it is possible to have indirect interests through private companies or other corporate structures. It’s a big company, so even a small percentage interest can create alignment between the board and shareholders. In this case, insiders own shares worth ₹140m. It’s always good to see at least some insider ownership, but it might be worth checking if those insiders have sold.

Common public ownership

The general public – including retail investors – owns 31% of the shares in the company, and therefore cannot be easily ignored. While this group doesn’t necessarily call the shots, it certainly can have a real influence on how the company operates.

Private company ownership

It appears that the private company owns 46% of Tata Power’s stock. It’s hard to draw any conclusions from this fact alone, so it’s worth finding out who owns those private companies. Sometimes insiders or other related parties are interested in shares of public companies through separate private companies.

Next step:

I find it very interesting to see who really owns the company. But to have a real understanding, we need to consider other data, too. Know that Tata Power is performing 2 warning signs in our investment analysis And 1 of them is about…

But in the end It is the future, not the past, to determine how good this business owner will do. So we think it’s worth looking at this free report showing how analysts are predicting a bright future.

NB: The figures in this article are calculated using data from the last twelve months, which refers to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not be consistent with the full year annual report numbers.

Valuation is complicated, but we help make it simple.

Find out whether Tathagata energy May be over or under by checking our comprehensive analysis, which includes Fair value estimates, risks and warnings, dividends, insider transactions and financial health.

See free analysis

Have an opinion on this article? Worried about content? Can be contacted with us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using unbiased methods and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any securities, and does not take into account your objectives, or your financial situation. We aim to bring you long-term focused analysis based on fundamental data. Please note that our analysis may not factor in company postings that are sensitive to the latest price or quality materials. Only Wall St has no position in any of the stocks mentioned.

[ad_2]

Source link